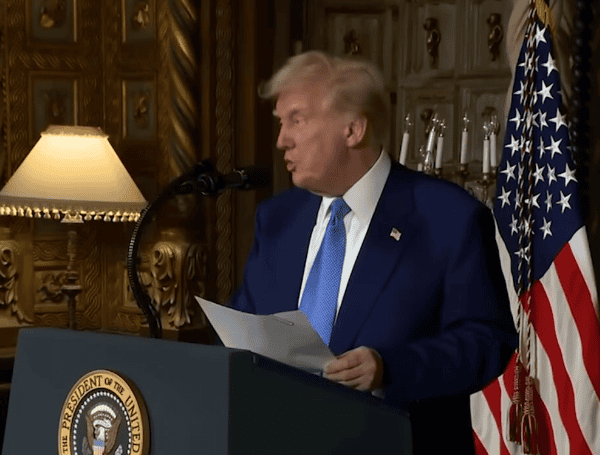

Wall Street experienced extreme volatility on Monday, with stocks swinging wildly up and down, as markets grappled with the potential economic fallout from President Donald Trump’s global trade war.

This turmoil mirrored dramatic losses seen in European and Asian markets, with U.S. indices also flirting with bear market territory and oil prices declining.

US Markets: The Dow Jones Industrial Average saw a dramatic intraday swing. After initially dropping by 1,700 points, it briefly surged by 800 points due to a false rumor about a tariff pause, only to then resume its downward trend, ending the morning down 629 points.

The S&P 500 also experienced sharp fluctuations, while the Nasdaq composite showed a slight gain of 0.2% in early trading.

READ: Peter Navarro Spars With CNBC Hosts On Whether Trump’s Tariffs Will Actually Work

European Markets: Germany’s DAX index experienced a sharp drop, briefly falling over 10% before recovering somewhat to a 5.8% loss in morning trading.

Similar declines were seen in other major European markets, with the CAC 40 in Paris down 5.8% and Britain’s FTSE 100 losing 4.9%.

Asian Markets: Hong Kong’s stock market suffered a significant plunge, with stocks dropping 13.2% for the worst single-day performance since 1997. Japan’s Nikkei index also fell sharply, tumbling nearly 8%.

The volatility extended beyond traditional markets, with cryptocurrencies also experiencing a sell-off. Bitcoin dipped below $75,000 on Monday morning before a slight rebound. Analysts noted that despite claims of being a hedge against volatility, Bitcoin’s price movements currently resemble those of a risky tech stock. Other major cryptocurrencies, including ether, XRP, and solana, saw even steeper percentage drops.

READ: EU Offers To Scrap Industrial Tariffs In Negotiations With US

Treasury yields were mixed in Monday morning trading, experiencing a brief rally before settling into a more uncertain pattern. The yield on the 10-year Treasury rose from 4.01% to 4.09%, after briefly falling to 3.88%.

The market’s extreme volatility was highlighted by a brief spike triggered by a social media report that White House economic advisor Kevin Hassett had suggested a potential 90-day pause on tariffs.

However, this report was quickly contradicted by a White House account, underscoring the market’s sensitivity to any news related to the trade war.

Despite the market turmoil, Treasury Secretary Scott Bessent has downplayed recession fears, stating that the administration will not change its course and that they are focused on long-term economic goals.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.