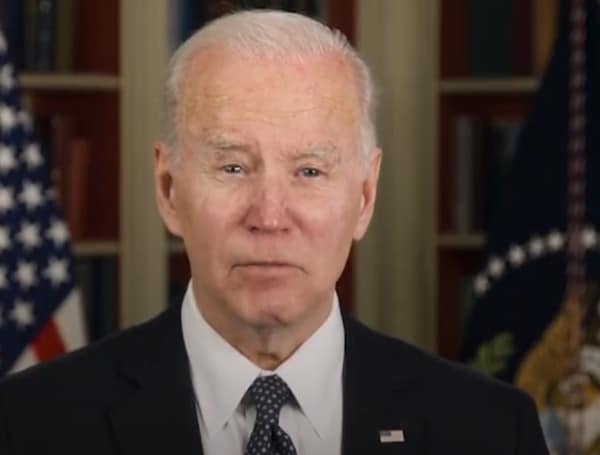

President Joe Biden has not done very much right since becoming president. But one plus is something he has not done.

Repeal former President Donald Trump’s tax cuts.

Few people know this, because of a general media blackout on the issue, but the federal government continues to haul in record amounts of tax revenue – under a taxing scheme reformed by Trump.

CNSNews.com columnist Terrence Jeffrey pointed out late last week that the U.S. government hauled in $4.05 trillion in tax revenue for fiscal year 2021, which ended on Sept. 30.

That was a record high. Additionally, that was $442 billion more than what the government collected in 2020, which admittedly was a year when much of the economy was shut down.

About half of that 2021 total was attributable to income taxes – almost all of which are paid by the wealthy.

According to the most recent IRS data, the top 20 percent of income earners pay 83 percent of all federal income taxes. Expand that to the top 50 percent, and we find that group pays 97 percent of the total.

And for all the bashing of corporations, and of Trump for cutting taxes on businesses, Jeffrey noted that corporate tax revenue in 2021 was $372 billion – about $75 billion more than the government received during former President Barack Obama’s last fiscal year when rates were higher.

Moreover, looking at 2022, the Treasury Department as of March 31 has already collected a record amount for the first half of any fiscal year, and is projecting to set a new high by raking in $4.4 trillion by Sept. 30.

But, as Jeffrey pointed out, Biden is not satisfied with this booming tax situation.

In a statement last week, the White House said Biden demands “new minimum taxes on billionaires and large corporations to make sure they’re paying their fair share.”

“The President believes that profitable corporations shouldn’t pay a lower tax bill than a middle-class family, and shouldn’t be able to avoid taxes by shipping jobs and profits overseas.”

But, as Jeffrey wrote, Biden “does not want to increase taxes to eliminate or diminish the deficit. He wants to increase taxes to spend more money.”

Biden’s budget proposals show the government running at least $1 trillion deficits through 2028 – even as revenues hit new heights, and as he clamors for higher taxes on wealth producers.

“Biden’s fiscal plan would permanently implant a larger federal government on future generations of Americans, and thus permanently increase the tax burden on future generations,” Jeffrey argued.

“If Biden were to succeed in increasing the corporation income tax to [his proposed rate of] 28%, it would impose increased costs on every American consumer who purchases products — with their own after-tax income — from the corporations Biden targets,” he continued.

“Biden is not a champion of the middle class. He is a champion of big government.”

The views and opinions expressed in this commentary are those of the author and do not necessarily reflect the opinion of The Free Press.

Visit Tampafp.com for Politics, Tampa Area Local News, Sports, and National Headlines. Support journalism by clicking here to our GiveSendGo or sign up for our free newsletter by clicking here.

Android Users, Click Here To Download The Free Press App And Never Miss A Story. Follow Us On Facebook Here Or Twitter Here.