The United States could default on its $36.2 trillion national debt as early as mid-July, unless Congress raises or suspends the debt ceiling, according to a new analysis released Monday by the Bipartisan Policy Center (BPC).

The forecast, based on updated fiscal and economic data, places the so-called “X Date” — the day the government can no longer pay all of its bills on time — between mid-July and early October 2025.

The analysis warns of mounting pressure on lawmakers to resolve fiscal disagreements that have paralyzed progress on raising the borrowing limit, as political divisions grow between House and Senate Republicans over competing budget resolutions.

READ: Top Trump Officials Accidentally Shared Yemen Strike Plans With Journalist In Signal Chat

“Fiscal responsibility is not just about avoiding financial calamity time and time again—it’s about ensuring economic stability and paying our bills on time,” said Margaret Spellings, BPC president and former U.S. Education Secretary. “Policymakers must commit to responsible budgeting, which starts with avoiding debt limit brinksmanship and its impacts on our economy.”

Congress last suspended the debt limit through January 1, 2025, under the 2023 Fiscal Responsibility Act passed during the Biden administration. When the suspension expired, the Treasury Department began deploying “extraordinary measures” to delay a default. Treasury Secretary Scott Bessent extended that window through June 27, but the clock is now ticking toward an uncertain mid-summer deadline.

The X Date range could narrow further depending on a variety of factors, including:

- Tax season revenues, particularly affected by IRS filing extensions in 12 states;

- Tariff collections;

- Hurricane season-related disaster spending;

- And delays or changes in federal spending under the Department of Government Efficiency (DOGE).

“If collections from tax season fall far short of expectations, there is a potential for heightened X Date risk in early June,” the report notes.

READ: Massive ICE Operation Nets 370 Illegal Aliens In Massachusetts: Targeting Gangs And Criminals

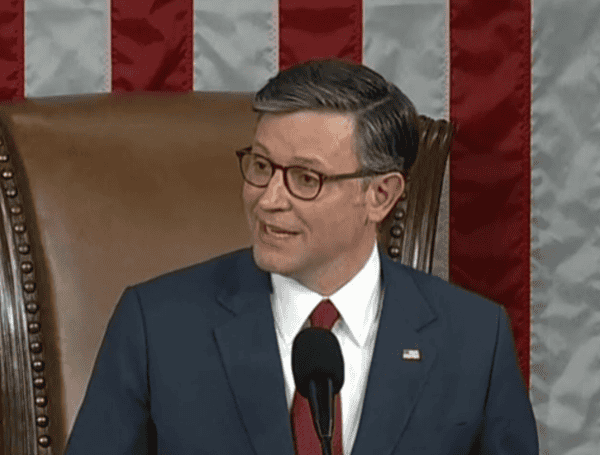

In Congress, efforts to raise the debt ceiling are currently stalled, with House and Senate Republicans backing competing budget resolutions as part of the reconciliation process — a special legislative route that allows a simple majority in the Senate.

The House GOP’s $4.5 trillion budget resolution, backed by President Donald Trump, proposes extending the 2017 Tax Cuts and Jobs Act (TCJA) by 10 years and raising the debt ceiling by $4 trillion. However, the Congressional Budget Office (CBO) estimates the plan could add $25 trillion to the debt over the next decade.

Meanwhile, Senate Republicans have championed a more modest $342 billion proposal focused on border security and defense spending, saving tax reforms for later. Senate Majority Leader John Thune (R-S.D.) initially called it a “backup plan” but now appears reluctant to abandon it, citing the steep cost of the House package.

READ: US Attorney General Pam Bondi Vows Crackdown On Fraud, Violent Crime In Fiery Remarks

President Trump has publicly endorsed the House version, calling it essential to implementing his second-term policy goals. The plan also includes significant increases in military spending and new investments in law enforcement and domestic energy production.

But critics — including some within the GOP — warn that passing a debt ceiling hike alongside costly tax extensions without offsets risks deepening long-term deficits. Even without the TCJA extension, the CBO projects U.S. debt will reach $52 trillion by 2035.

“Congress has a full plate in 2025, but addressing the debt limit well ahead of the X Date should rise to the top of the priority list,” said Shai Akabas, BPC’s vice president for economic policy. “History has shown that even approaching the X Date can lead to market volatility, higher borrowing costs, and reduced confidence in U.S. fiscal stability.”

READ: Air Force Awards Boeing Contract For F-47 Fighter Jet: “World’s Most Advanced Warplane”

To move forward with reconciliation, both chambers must pass the same budget resolution — a politically fraught task given the competing priorities and economic risks. Without a resolution, the U.S. risks market instability, credit downgrades, and delayed payments to Social Security recipients, federal workers, and government contractors.

With just months remaining, analysts and economists are urging lawmakers to act swiftly.

“This year presents many opportunities to begin getting our fiscal house in order,” said Spellings. “But that must begin with preserving the full faith and credit of the United States.”

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.