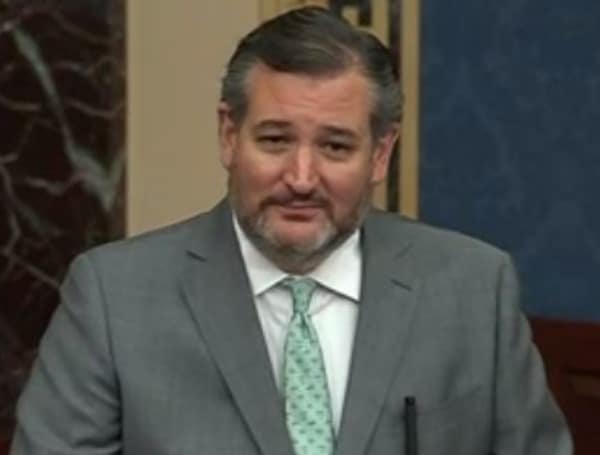

U.S. Senator Ted Cruz (R-Texas) has spearheaded the introduction of the “No Tax on Tips Act.” This legislation aims to exempt tips from federal income tax, providing much-needed relief to workers in industries that rely heavily on tipped wages.

Joined by Senators Steve Daines (R-Mont.), Rick Scott (R-Fla.), and Kevin Cramer (R-N.D.), Sen. Cruz’s initiative has garnered widespread support from industry groups, including the National Restaurant Association and the Professional Beauty Association.

Tipped wages play a crucial role in supporting millions of American workers across diverse industries, from restaurants and bars to beauty salons and barbershops. These workers rely on the tips they earn to supplement their incomes and make ends meet, especially in the face of the current economic challenges posed by historic inflation under the Biden administration.

Read: Texas Sen. Ted Cruz’s Bill ‘TAKE IT DOWN’ Act Tackles Scourge Of Deepfake Revenge Porn

With inflation driving up costs and eroding the purchasing power of American families, tipped workers have found themselves particularly vulnerable.

As inflation soars to two-decade highs, these hardworking individuals are struggling to keep up with the rising prices of essential goods and services, making it increasingly difficult to support themselves and their loved ones.

Tipped workers are the backbone of many industries, providing invaluable services that enhance the customer experience and contribute to the vitality of local businesses. From the friendly servers who deliver exceptional service in restaurants to the skilled professionals who transform our appearances in beauty salons, these individuals play a vital role in shaping the economic and social fabric of communities across the country.

The “No Tax on Tips Act” introduced by Sen. Cruz and his colleagues represents a common-sense approach to supporting tipped workers and their families. By exempting tips from federal income tax, this legislation would put more money directly into the pockets of those who have earned it through their hard work and dedication.

Read: Texas Sen. Cruz, Colleagues Applaud House Efforts On ICC Sanction After Actions Against Israel

“American workers in dozens of industries depend on tipped wages to support themselves. Today, I am introducing pro-worker legislation, the No Tax on Tips Act, to ensure they get to keep all of those tips. This legislation is a common-sense pro-worker bill that will help families deal with the historic inflation caused by the Biden administration,” said Cruz.

The bill would provide immediate tax relief for over 2.2 million restaurant employees and 1.3 million licensed beauty professionals, allowing them to keep more of their hard-earned tips.

This would help offset the financial strain caused by the Biden administration’s inflationary policies, empowering tipped workers to manage their household budgets better and make ends meet.

The bill is co-sponsored by Sens. Steve Daines (R-Mont.), Rick Scott (R-Fla.), and Sen. Cramer (R-N.D.) and has the support of industry groups, including the National Restaurant Association.

Help support the Tampa Free Press by making any small donation by clicking here.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.