President Joe Biden’s student loan giveaway continues to generate challenges and raise questions from Republicans.

Another example came up this week.

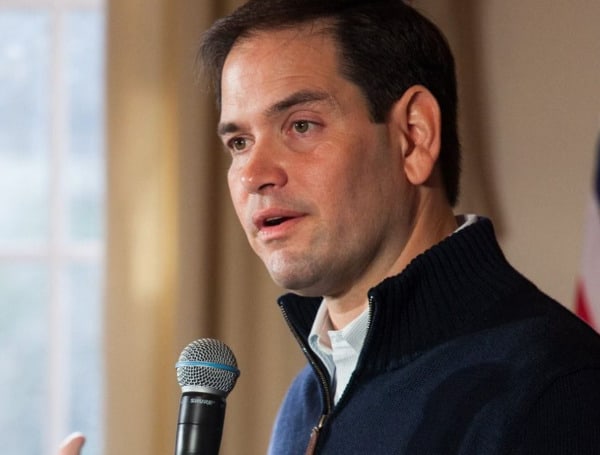

Arkansas Republican Sen. Tom Cotton, joined by nine other GOP lawmakers, including Florida Sen. Marco Rubio, asked the administration to explain how Biden’s deal affects thousands of federal employees whose college loans were paid through taxpayer-funded programs.

In their letter to Secretary of Education Miguel Cardona, the lawmakers noted Cardona recently announced that federal student loan borrowers who made repayments since March 13, 2020, will receive an “automatic refund” for their payments.

This is because both the requirement to make those payments and the accruing of interest were paused during the pandemic.

In the news: Rep. Gaetz Slams Pelosi, Democrats For Misleading Americans About Inflation

Yet the federal government “already offers generous repayment programs to its employees,” the letter noted, adding, that process “continued during the pandemic.”

Overall, roughly 2,000 Capitol Hill staffers and 10,400 executive branch employees benefit from these repayment plans.

“Your current guidance raises the troubling possibility that over 12,000 federal employees who benefit from these taxpayers’ funded repayment programs could receive direct checks to ‘reimburse’ them for loan repayments already made by taxpayers,” the Republicans’ letter argued.

“Your Department explicitly tells borrowers that payments can only be ‘refunded to you, even if someone else made a payment on your loan,’” the senators wrote.

Consequently, “This could allow federal employees to receive thousands of dollars in refunds for student loans payments that they never actually made themselves,” they added.

Cardona was supposed to have responded to the questions from the GOP senators by Friday.

They want him to explain whether he will give a “refund” to any federal employee who had repayments made on their behalf by the federal government since March 2020.

The lawmakers also wanted to know what would happen if a federal employee with a $20,000 federal student loan balance in March 2020 stopped making payments.

In the news: Florida Fentanyl Dealer Gets 20 Years In Prison After His Product Kills A Man

As one example, they asked if someone who received taxpayer benefits that paid their balance down to zero over the course of the pause on repayment, could that borrower apply to have $20,000 “refunded” to them.

It’s unclear what defense, if any, Cardona offered.

Visit Tampafp.com for Politics, Sports, and National Headlines. Support journalism by clicking here to our GiveSendGo or sign up for our free newsletter by clicking here.

Android Users, Click Here To Download The Free Press App And Never Miss A Story. Follow Us On Facebook Here Or Twitter Here.

Copyright 2022 The Free Press, LLC, tampafp.com. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.