The logo of the #1 business credit builder, Wealth Builders 365.

The advantages of good business credit

Unlocking Business Success as Wealth Builders 365 Study Reveals Pivotal Benefits of Established Business Credit for Growth and Financing.

MIAMI BEACH, FLORIDA, UNITED STATES, January 24, 2024 /EINPresswire.com/ — Report Wealth Builders 365 Study Reveals Striking Advantages for Businesses with Established Business Credit

In a groundbreaking study by Wealth Builders 365, businesses with established business credit are emerging as frontrunners in securing financing, enjoying lower interest rates, and accessing diverse financial options. The comprehensive survey, conducted from our headquarters in the vibrant city of Miami, Florida, sheds light on the substantial benefits that businesses with a robust credit history can reap compared to their counterparts without business credit.

Empowering Business Growth: A Boom for Entrepreneurs

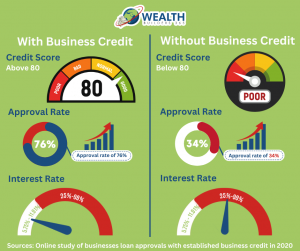

Small businesses form the backbone of our economy, and at Wealth Builders 365, we believe in providing them with the tools they need to survive and thrive. Based on data from 2020, the study reveals that businesses registered with a low risk naics code and a solid business credit score of 80 or above witnessed an impressive approval rate of 76% for financing, as opposed to a mere 34% for businesses without a business credit score. This higher approval rate increases entrepreneurs’ opportunities to secure the funding essential for their growth and expansion.

Access to capital is often a major hurdle for businesses, especially those in their early stages. Established business credit allows companies to qualify for better terms and conditions from lenders, leading to lower interest rates. According to the findings, the average small business bank loan interest rate for those with good credit ranged from 5.75% to 11.91%, significantly lower than the 25% to 99% or higher interest rates faced by businesses with poor credit. This cost advantage can free up business resources to invest in their operations, fueling further growth.

Why Building Business Credit Matters: Key Takeaways

The survey highlights several compelling reasons why businesses should prioritize building and maintaining a strong business credit profile:

Higher Approval Rates: Businesses with established business credit are more likely to secure financing, providing them with the necessary capital to fuel their operations, expand, or navigate challenging times.

– Lower Interest Rates: A solid business credit score translates into lower interest rates, reducing the overall cost of borrowing and improving a business’s financial health.

– Diverse Financing Options: With good credit, businesses access various creative financing solutions, providing flexibility to meet specific needs.

– Larger Loan Amounts: A strong credit history enables businesses to qualify for larger loans, supporting ambitious growth plans and strategic initiatives.

At Wealth Builders 365, we understand the significance of these findings and are committed to providing comprehensive solutions to empower businesses on their journey to success.

About Wealth Builders 365: Empowering Businesses Since 2020

Wealth Builders 365, founded in 2020 in the dynamic city of Miami, Florida, has been on a mission to empower small businesses and consumers with innovative financing solutions and expert do it yourself credit repair assistance. We firmly believe that every business deserves access to capital, regardless of their credit history, revenue, or industry.

Our specialized services include creative small business financing, credit monitoring, incorporating services, business credit building software, and consumer credit repair software. At Wealth Builders 365, we strive to be the ultimate destination for businesses seeking the resources they need to thrive and achieve their goals. Learn more at https://wealthbuilders365.com.

Contact Information:

For media inquiries or further information, please contact:

Josiah Wiley

Wealth Builders 365

+1 3052502428

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

TikTok