Thomas Catenacci

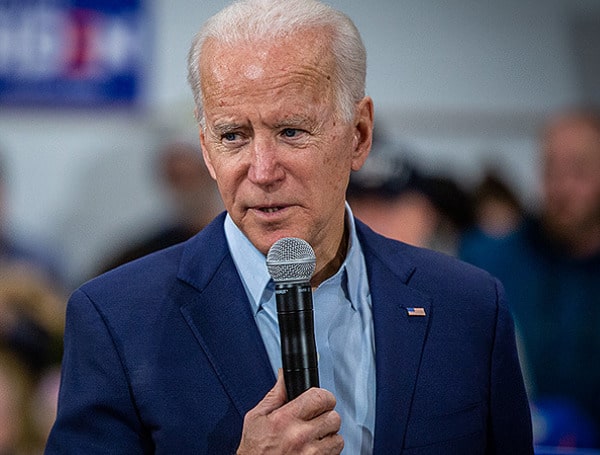

Domestic and international oil price indices rose Tuesday, even after President Joe Biden and other world leaders coordinated a release of emergency reserves.

The West Texas Intermediate (WTI) crude oil index, which measures U.S. prices, increased more than 2% to $78.44 per barrel while the European Brent Crude index ticked up nearly 3%, hitting $82 per barrel.

But, in an effort to knock down high gasoline prices, which are tied to the cost of oil, Biden joined several nations, including China, Japan and the U.K., in releasing tens of millions of barrels of oil from emergency reserves.

The White House said the U.S. would withdraw 50 million barrels from its Strategic Petroleum Reserve (SPR), established in the 1970s for future energy crises and currently holding about 604 million barrels in inventory. The U.S. consumes 18-19 million barrels of oil per day, and the world consumes nearly 100 million total barrels per day, according to the International Energy Agency.

“Joe Biden is going to release 50 million barrels of oil from the Strategic Petroleum Reserve. That is less than three days of U.S. oil consumption,” Steve Milloy, a former member of the Trump transition team, tweeted. “The release will have no meaningful impact on gas prices. Ridiculous.”

“Biden could collapse the price of oil today and create an economic boom by simply ending his war against fracking and returning to the Trump policy of energy dominance,” Milloy continued. “Instead, we get this trivial release of oil and a false accusation so price gouging.”

Energy industry experts and Republican lawmakers echoed Milloy’s comments Tuesday, arguing the move was driven by politics rather than a desire to lower prices over the long term. Democratic Sen. Joe Manchin, the chairman of the Senate Energy and Natural Resources Committee, shared in the criticism, saying Biden should do more than apply a “band-aid” to fix the issue.

“Historic inflation taxes and the lack of a comprehensive all-of-the-above energy policy pose a clear and present threat to (Americans’) economic and energy security that can no longer be ignored,” Manchin said in a statement.

The president previously acknowledged that releasing emergency reserves would have a limited impact.

The price of oil is likely to stay elevated since the market has already reacted to the emergency reserve release, according to a recent Goldman Sachs industry report. Investors expected such a move, the report added.

“It’s going up because it’s not more, and (investors are) reading no changes in the US policies towards oil and gas production,” Dan Kish, a senior fellow at the Institute for Energy Research, told the Daily Caller News Foundation.

Biden has pursued an aggressive climate agenda, attacking the U.S. oil and gas industry by nixing pipelines, ditching drilling projects and introducing broad regulations. He also accused the industry of price gouging in a letter to the Federal Trade Commission.

Check out Tampafp.com for Politics, Tampa Local News, Sports, and National Headlines. Support journalism by clicking here to our GoFundMe or sign up for our free newsletter by clicking here. Android Users, Click Here To Download The Free Press App And Never Miss A Story. It’s Free And Coming To Apple Users Soon.