Higher-income Americans took home the lion’s share of green energy tax credits for residential items deployed by the Biden administration in tax year 2023, according to Internal Revenue Service (IRS) data analyzed by the Daily Caller News Foundation.

Around $5.5 billion of the approximately $8.4 billion in tax credit claims doled out for residential energy tax credits came from filers earning more than $100,000 annually, with six-figure-plus earners over three times more likely to claim the credits, according to the IRS data.

Residential energy tax credits are composed of two parts, “energy efficient home improvement credits” for purchases like upgraded heat pumps and air conditioners and “residential clean energy credits” for purchases like solar panels and batteries, both of which were significantly expanded under the 2022 Inflation Reduction Act (IRA), according to the U.S. Department of Treasury.

Read: Florida GOP Voters Outweigh Democrats More Than Double With In-Person Early Voting

“Americans making an average or below-average income don’t have extra room in the budget for electric vehicles and solar panels or to invest in green energy companies,” Preston Brashers, a research fellow for tax policy in The Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF. “Many everyday Americans can barely afford groceries and rent, let alone Energy Star-rated homes filled with energy-efficient appliances.”

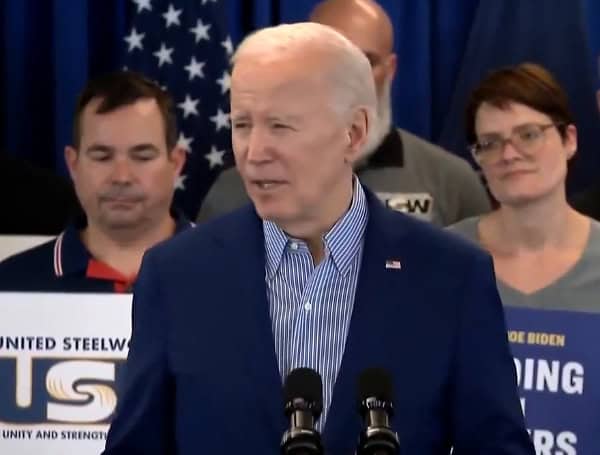

The IRA is President Joe Biden’s signature climate bill, which allocated $370 billion for green initiatives out of the $750 billion in new federal spending that it authorized. As part of this spending, the IRA expanded energy efficient home improvement credits from 10% of project costs to 30%, with varying limits based on the type of purchase, and expanded the residential clean energy credit to include battery storage systems, according to the U.S. Energy Communities Interagency Working Group.

Read: ICE Boston Arrests Haitian National In Brockton For Raping Child In Shelter After Court Release

“These credits are overwhelmingly benefiting middle-class families, and nearly half of the families who claimed one or both credits had incomes of less than $100,000 in 2023,” a spokesperson for the Treasury Department told the Daily Caller News Foundation. “More broadly, the Inflation Reduction Act is delivering investment to left-behind places — communities at the forefront of fossil fuel energy production and those that have benefited least from the economic growth of the past few decades.”

While the Treasury is correct that just under half of the families who claimed credits had incomes of less than $100,000, those families claimed far fewer total tax credit dollars, with filers making over $100,000 claiming twice as many tax credit dollars for residential clean energy and around 65% more tax credit dollars for home energy efficiency, according to the IRS data. Moreover, 75.7% of filers earn less than $100,000, meaning those making over $100,000 a year were twice as likely to take advantage of residential clean energy credits and four times as likely to take advantage of home energy efficiency credits.

While the White House claims these green technologies will save low-income families money, the high upfront costs can be prohibitive. The average cost of a residential solar panel system in the U.S. is roughly $18,600 in 2024, falling to approximately $13,000 after a 30% federal solar tax credit is applied, according to Forbes.

Read: Biden Admin Cements Gas Stove Rule After Insisting It Isn’t Going After Gas Stoves

The solar credit was first created under former President George W. Bush’s 2005 Energy Policy Act and was expanded under former President Barack Obama’s American Recovery and Reinvestment Act, according to the Solar Energy Industries Association. The solar credit is nonrefundable, meaning if someone does not make enough money and their tax refund exceeds their tax bill, they do not receive the difference from the IRS, NerdWallet reported.

At the same time, the Biden administration has been creating regulations on key appliances like air conditioners, refrigerators, water heaters and furnaces, that are set to increase expenses for the average American home by more than $9,000 due to compliance efforts.

“This is all truly an indictment of the environmental justice narrative that is used to sell these types of programs and push progressive lifestyle choices onto everyday people,” O.H. Skinner, executive director of the Alliance for Consumers and the former solicitor general of Arizona, told the DCNF in reference to the residential tax credit program. “The left is aware of this, and in turn says that it is the emissions reductions that benefit the poor, even if that means we have to subsidize the rich… That galling message is cold comfort to most consumers, who see their taxes go up, their electric bills go up, the costs of goods go up… and their household appliance costs go through the roof, while high earners cash tax credits for their fancy progressive lifestyle choices.”

A study published in July by the National Bureau of Economic Research found that the majority of the $47 billion in green tax credits claimed between 2006 and 2021 went to households in the top 20% of incomes earned.

The Biden administration’s climate-green push comes as many Americans are struggling to pay their bills, with both credit card balances that are more than 60 days overdue and revolving balances reaching their highest point in the first quarter of 2024 since the Federal Reserve Bank of Philadelphia began tracking 12 years ago. Overall prices have risen more than 20% since Biden took office in January 2021, with electricity prices having increased over 30%, according to FRED.

“It is clear that the tax credits in the Inflation Reduction Act primarily benefit wealthier Americans,” Ben Lieberman, senior fellow at the Competitive Enterprise Institute, told the DCNF. “The regressive nature of these provisions flies in the face of the [Biden administration’s] environmental justice rhetoric.”

The IRS deferred to the Treasury Department, and the EPA did not respond to a request for comment from the DCNF.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Android Users: Download our free app to stay up-to-date on the latest news.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.

First published by the Daily Caller News Foundation.