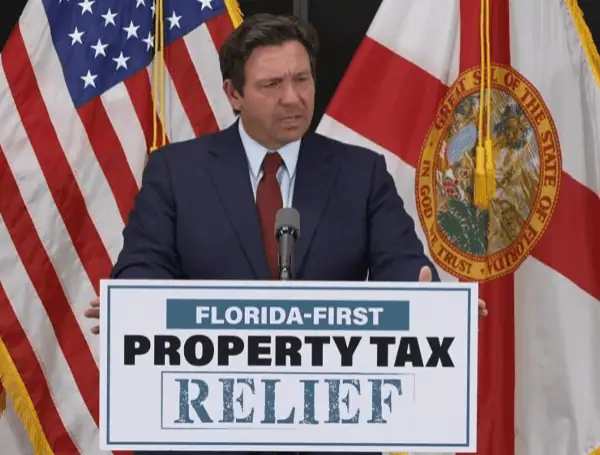

Governor Ron DeSantis unveiled a bold new proposal Monday to deliver $5 billion in property tax relief to Florida’s homesteaded homeowners, calling it a “Florida-First Tax Package” that prioritizes residents over tourists and non-resident investors.

In a detailed announcement, DeSantis said the proposed plan would amount to an average $1,000 tax cut for every homeowner claiming a homestead exemption in Florida — a move he says will “put money back in the pockets of hardworking Floridians” and reinvigorate the state’s housing market.

“We’ve done record tax relief every year I’ve been governor, but this is the boldest plan yet,” DeSantis said. “You shouldn’t have to keep paying rent to the local government just to enjoy your own home.”

READ: Tech Groups Renew Legal Fight Against Florida’s Social Media Law

DeSantis took aim at what he called “excessive” local spending and an outdated system that taxes property owners year after year, unlike one-time sales taxes on items like TVs or vehicles.

“When I buy a TV, I pay the sales tax once. But for my house, I’m essentially paying rent to the government forever. That doesn’t sit right with people,” he said.

The governor emphasized that Florida’s unique economy — with a steady influx of tourists and part-time residents — allows the state to shift more of the tax burden away from full-time homeowners without sacrificing essential revenues.

DeSantis praised House leadership for floating a $5 billion tax relief package, but criticized their current plan to cut the state sales tax by three-quarters of a penny.

READ: Gov. DeSantis Announces Over $389 Million In Water Quality, Supply Grants Across Florida

“Floridians aren’t clamoring for a sales tax cut — they’re demanding property tax relief,” he said. “We don’t need to be giving tax breaks to foreigners and tourists. This should be for Floridians, period.”

Under DeSantis’ plan, the $5 billion would come from Florida’s budget surplus and rainy day fund reserves, which have grown significantly during his tenure. The proposed relief would target:

- Homesteaded homeowners, not investors or non-residents

- Rollback of required local effort taxes for schools, which the state would fully backfill

- Direct rebates for some local government line items

DeSantis said this structure would provide meaningful savings without impacting public education or local services.

The governor also recapped his administration’s broader tax record, including:

- $2.5 billion in tax relief in 2022

- Toll rebates for daily commuters

- Sales tax holidays for back-to-school, hurricane prep, and tools for skilled workers

- Permanent tax exemptions on baby items

- Gas tax holidays and boating fuel breaks

- Second Amendment sales tax holidays

- Elimination of the business rent tax

READ: Border Czar Tom Homan, Florida Gov. Ron DeSantis Call Out GOP Holdouts On Immigration

DeSantis argued that Florida’s combination of no income tax, low sales taxes, and now, potentially, lower property taxes makes it the most economically attractive state in the country.

“We’re not California,” he said. “They’ve got high income taxes, the highest sales tax in the country, and crushing property taxes. Florida is proving you can do it better.”

While the current proposal offers immediate relief, DeSantis hinted at an even more ambitious plan on the horizon: a constitutional amendment in 2026 to permanently reform the state’s property tax structure.

“This is just the opening salvo,” he said. “We want to show that this can be done — responsibly, effectively — and then bring the question to the voters.”

DeSantis acknowledged the impact of high property taxes on Florida’s real estate market, especially for families looking to move within the state.

READ :Florida Gov. DeSantis Announces Early Completion Of NASA Causeway Bridge

“It makes it harder for people to move from Tampa to Jacksonville, or from Orlando to Pensacola, when they’re going to get hit with a much higher tax bill,” he said.

With interest rates and insurance costs already dampening the housing market, the governor believes this relief could stimulate more activity while helping middle-class families stay afloat.

The proposal now heads to the Florida Legislature, where DeSantis hopes lawmakers will back the homestead-focused approach over broader sales tax cuts. If passed, the relief could be felt as early as late 2025, with noticeable savings appearing in end-of-year property tax statements.

“We control the tax system. We have the surplus. And we have the responsibility to provide relief,” DeSantis concluded. “Let’s get it done.”

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.