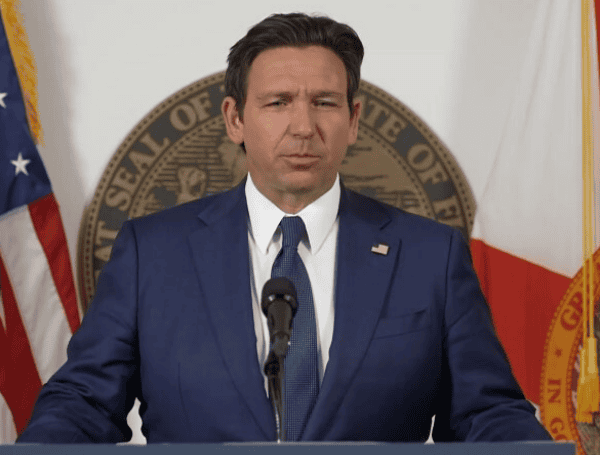

Governor Ron DeSantis unveiled significant progress in Florida’s insurance market during a press conference in Miami today, announcing rate reductions for homeowners and auto insurance, as well as the entry of 11 new insurance companies into the state. These developments come as a result of sweeping reforms aimed at stabilizing the market, reducing litigation, and providing relief to Floridians facing rising premiums.

Homeowners’ Insurance Relief

Governor DeSantis announced that Citizens Property Insurance Corporation, the state’s insurer of last resort, will implement premium decreases for 75% of policyholders in Miami-Dade County, with statewide reductions averaging 5.6%. This marks a significant shift from previous years, when Florida homeowners faced some of the highest insurance rates in the nation due to inflation, active hurricane seasons, and rampant litigation.

READ: Florida Rep. Brian Mast Weighs In On “The Riviera Of The Middle East”

“For the last four years, inflation spurred by the Biden Administration, active hurricane seasons, and unchecked litigation in Florida created an environment that caused turbulence in insurance markets and steep increases in premiums,” said Governor DeSantis. “But thanks to our reforms, Florida now has the lowest average homeowners’ premium increases in the nation, and the overall market has stabilized.”

The Governor highlighted that Florida’s average homeowners’ insurance rate increase for 2024 is just 1%, compared to double-digit increases in other states. Additionally, 60% of the state’s top 10 insurance carriers have expanded their business, while 40% have filed for rate decreases. Citizens Property Insurance, which had been rapidly growing due to a strained private market, is now shrinking, with over 20% of policyholders experiencing rate decreases.

Auto Insurance Rate Reductions

In addition to homeowners’ insurance relief, Governor DeSantis announced significant reductions in auto insurance rates. Major insurers such as GEICO, State Farm, and Progressive have filed for rate decreases of 10.5%, 6%, and 8.1%, respectively. These reductions are partly attributed to a dramatic decline in litigation related to auto glass repairs, which dropped from 24,720 lawsuits in the second quarter of 2023 to just 2,613 in the same period of 2024.

“Floridians are seeing real savings thanks to our reforms,” said Governor DeSantis. “These rate reductions are a testament to the hard work we’ve done to stabilize the market and protect consumers.”

READ: Illegal Alien Arrested On Drug Charges In Sarasota; Immigration Hold Placed

New Companies Enter the Market

Governor DeSantis also announced that 11 new insurance companies have entered or expanded in Florida’s market over the past two years, reflecting renewed confidence in the state’s insurance landscape. This influx of competition has contributed to a 4% increase in the number of active insurance policies, now totaling 7.58 million statewide.

Landmark Reforms Drive Progress

Since 2019, Florida has passed five landmark laws aimed at reforming the insurance market. Key measures include:

- HB 7065 (2019): Curbed abusive litigation tied to Assignment of Benefits (AOBs).

- SB 76 (2021): Tightened claim deadlines and encouraged dispute resolution over lawsuits.

- SB 2D (2022): Eliminated one-way attorney fees for AOBs, limited roofing scams, and created a $2 billion Reinsurance to Assist Policyholders (RAP) program.

- SB 2A (2022): Reduced frivolous litigation, strengthened insurer accountability, and protected consumers.

- 2023 Reforms: Eliminated subsidies for out-of-state vacation homes, expanded home hardening programs, and enhanced oversight of insurers.

These reforms have not only stabilized the market but also driven down costs for consumers. The average rate increase for homeowners’ insurance has dropped from over 21% in 2023 to a projected 0.2% for 2025.

Consumer Savings Across the State

The impact of these reforms is being felt across Florida. In Miami-Dade County, nearly 75% of homeowners are seeing rate reductions, while over 50% in Broward County and nearly 19% in Palm Beach County are benefiting from lower premiums. Since 2022, more than 477,000 policies have returned to the private market—up from just 16,408 in 2022—signaling increased competition and better options for consumers.

Governor DeSantis emphasized that these reforms are just the beginning. “We’ve made tremendous progress, but there’s still more work to do,” he said. “Our goal is to ensure that Florida remains a place where families can afford to live, work, and thrive.”

As Florida continues to recover from years of insurance market instability, the state’s efforts to reduce litigation, attract new insurers, and lower premiums are providing much-needed relief to homeowners and drivers alike. With 11 new companies entering the market and rates decreasing across the board, Florida’s insurance landscape is poised for a brighter future.

For now, Floridians can celebrate the tangible benefits of these reforms, knowing that their leaders are committed to protecting their wallets and their homes.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.