U.S. Representatives Matt Gaetz (FL-01) and Thomas Massie (KY-04) introduced the “Tax Free Tips Act of 2024,” aiming to alleviate the financial burden on service industry workers by removing federal income and employment taxes on tips.

This legislation aligns with a top priority of former President Donald Trump.

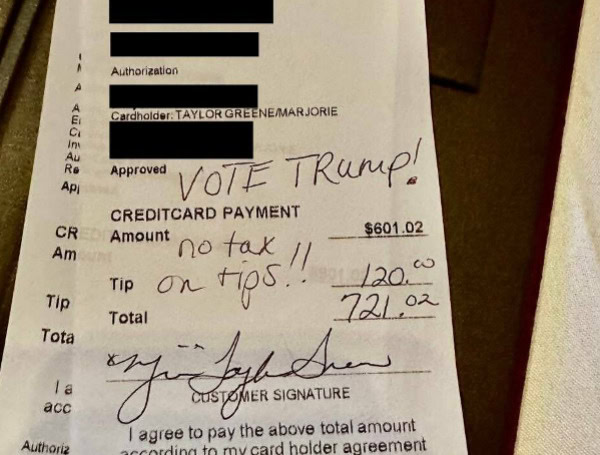

Representative Marjorie Taylor Greene (GA-14) is an original co-sponsor of the bill.

“As the cost of living continues to rise, the hardworking men and women in the service industry, many of whom may be working a second job to make ends meet, must be allowed to keep every dollar of tip money they earn. I am proud to join with Rep. Thomas Massie in co-leading this important tax-relief legislation,” said Gaetz.

“Ron Paul had it right and so does Donald Trump,” said Rep. Thomas Massie (R-KY). “Taxing tips is regressive and goes against American tradition. But now digital payments allow the government to tax every transaction, even those that historically have not been taxed. With inflation raging, it only makes sense to eliminate the tax on tips and provide relief to working folks.”

Last week in Las Vegas, Trump announced a new policy that, if he’s elected, would end assessing income taxes on tips.

“It’s been a point of contention for years and years and years,” Trump said at a Vegas rally. “It’s something that really is deserved. … I think it’s never been brought up before, and I also think it’s very appropriate.”

Republican lawmakers have picked up Trump’s cue.

Read: Possibility Of Trump Victory Has Liberal Groups Flustered And Scrambling To Prepare

On Friday, GOP Rep. Thomas Massie of Kentucky posted on X: “This week Trump suggested we shouldn’t tax tips. He’s right. Next week I’ll be re-introducing @RonPaul’s original Tax Free Tips Act to eliminate taxes on tips!”

Paul, a former Republican congressman from Texas and father of Se. Rand Paul, had filed such a bill in March 2011. He promoted the idea while running for president in 2012.

In a January 2012 opinion article, Rep. Paul wrote, “It’s an outrage that waiters, waitresses and other service-sector employees have to pay taxes on the tips they earn. And to add insult to injury, the IRS makes an estimate of how much service-sector workers will make in tips and taxes them on it even if the taxpayer did not actually earn as much as the IRS estimate!”

“I understand ending taxes on tips will give these workers a pay raise, letting them keep more money to put toward things like a house or car payment, their retirement, or their own and/or their children’s education. If elected president, I will end this injustice on service-industry workers all across our nation by abolishing all taxes on tips once and for all.”

After Trump’s announcement, Republican Sen. Kevin Cramer of North Dakota told The Hill, “This tips thing was genius. [Trump] was like, ‘I’d love to tell you it was based on a bunch of research, but it was based on a discussion with a waitress who said, ‘They’re coming after my tips.’”

Read: Baseball Fan Backflips In The Outfield But Can’t Outrun An Officer’s Taser! LEO Talk Show

On X, Georgia Rep. Marjorie Taylor Greene urged Trump fans to write the message on their receipts as they tip servers.

“I absolutely LOVE President Trump’s plan for NO TAX ON TIPS!! Write it on every receipt you sign!” she posted.

Conservative activist Scott Presler added on X, “The next time you go out to eat or visit a bar, please tip & write on the receipt, ‘Elect Trump & you’ll keep 100% of your tips.’ Take a picture & let’s grow the trend. Trump Won’t Tax Tips.”

Help support the Tampa Free Press by making any small donation by clicking here.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.