The Florida House on Wednesday rolled out a proposal to divest an estimated $277 million in state pension-fund investments in Chinese state-owned companies.

The proposal, approved by the House State Affairs Committee, would require the State Board of Administration to develop a plan for selling holdings tied to Chinese companies by Sept. 1 and complete divestment within one year. The State Board of Administration invests state money, including in the pension fund.

In introducing the proposal, Rep. Mike Caruso, R-Delray Beach, said the federal government has imposed sanctions against the Chinese government.

Read: Florida Rep. Gaetz Pushes To Close “Lawless” Loophole On Feds Obtaining Phone Data, Without Warrants

“The government of the People’s Republic of China, together with the Chinese Communist Party and Chinese military, have long engaged in activities contrary to the interests of the United States,” Caruso said.

The proposal would prohibit pension-fund investments involving companies linked to the Chinese government, the Chinese Communist Party and the Chinese military.

A House analysis said investments in more than 200 Chinese state-owned entities accounted for $277 million, or 0.16 percent, of the retirement system fund.

Of that, $53.6 million is linked to China Construction Bank Corp. and $46.4 million is in Kweichow Moutai, which specializes in a particular Chinese liquor.

The majority of the investments are under $5 million.

Read: Florida Rep. Byron Donalds Rips Biden After U.S. House Impeaches Mayorkas ‘Secure Our Nation’

The Senate Governmental Oversight and Accountability Committee last week approved a similar bill (SB 7060), which needs approval from the Fiscal Policy Committee before it could go to the full Senate.

The bills come after a series of efforts by state leaders to try to cut economic ties with China and other countries.

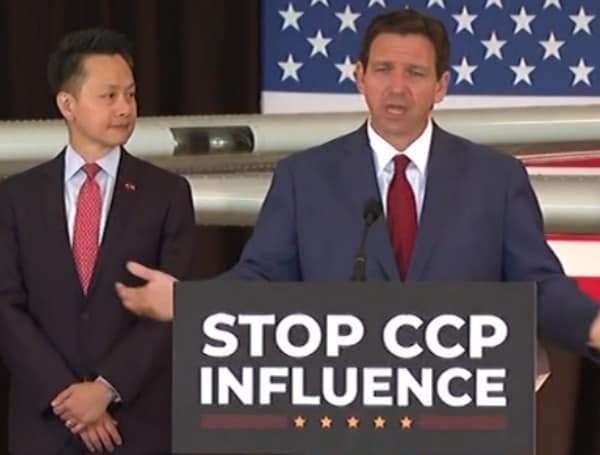

In December, 2021, Gov. Ron DeSantis, Attorney General Ashley Moody and Chief Financial Officer Jimmy Patronis, in their role as trustees of the State Board of Administration, directed a review of Florida Retirement System investments to find links to the Chinese Communist Party.

In March 2022, Lamar Taylor, the interim executive director and chief investment officer of the State Board of Administration, announced officials were pausing new investments in China, which had been part of the state’s “emerging market strategies” since the mid-1990s.

The state has imposed similar bans about Cuba since 1993, Sudan and Iran since 2007 and Venezuela since 2018.

For the past eight years, the state also has prohibited investments in companies engaged in an economic boycott of Israel.

DeSantis and Republican leaders have particularly targeted issues related to China in recent years.

One law, dubbed the “Combating Corporate Espionage in Florida Act,” would lead to felony charges for “trafficking in trade secrets.” Another requires entities seeking state grants or contracts to report receiving certain gifts or grants “from any foreign source.”

Meanwhile, the 11th U.S. Circuit Court of Appeals is set to hear arguments in April about part of a 2023 state law that places restrictions on people from China and other “foreign countries of concern” owning property in the state.

People from China in the United States on visas or seeking asylum and a real-estate broker argue the law is unconstitutional and violates the federal Fair Housing Act.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.