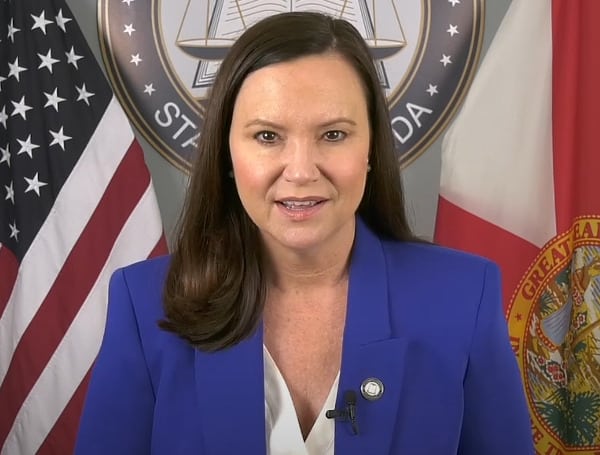

In the second chapter of the 2024 Tax Season Scam Series, Attorney General Ashley Moody warns Floridians of tax debt relief schemes.

In 2022, the Internal Revenue Service revealed that more than 18 million filers owed more than $300 billion in delinquent taxes.

Scammers may try to deceive those who owe taxes by promising extremely low-cost tax debt reduction options. Attorney General Moody has issued advice to help Floridians avoid fraud.

Read: Sheriff Grady Judd Says Squatters Will Get A “One-Way Ride” To Jail In Florida

“Tax debt relief scams prey on the stress that often accompanies tax season for those who owe the IRS. These bad actors will reach out in any way possible: texts, phone calls, emails, letters—all to try and trick consumers into believing a tax expert is interested in helping them get out of a difficult situation, when really the scammer is interested in the victim’s personal or financial information. That’s why I’m offering tips to Floridians to avoid these scams,” said Moody.

In a tax debt relief scheme, scammers will attempt to contact individuals through emails, letters, phone calls or text messages, claiming to have a special program or insider knowledge that allows for negotiations with the IRS on behalf of the taxpayer.

The fraudsters may promise to settle tax debts for pennies on the dollar, often using high-pressure tactics to coerce victims into immediate action.

Read: Former MSNBC Host Chris Matthews Suggests ‘Poor People’ Think Trump Is ‘God’

Attorney General Moody offers the following tips to help Floridians avoid falling victim to tax debt relief scams:

- Attempt to Resolve Tax Debt with IRS First: call the IRS directly and ask about collection alternatives. Taxpayers may be eligible for a monthly payment plan or to pay less than the amount owed;

- Verify the Legitimacy of a Company: Before engaging with any offer for tax relief services, research the company thoroughly. Check for complaints, online reviews and verify credentials with relevant regulatory bodies;

- Beware of Unsolicited Communications: The IRS will never initiate contact through emails, phone calls or text messages;

- Avoid Providing Personal Information: Never share sensitive information with unknown individuals or companies; and

- Consult with a Trusted Tax Professional: Seek guidance from a qualified tax professional or attorney for a second opinion about potential tax relief offers.

To find professional tax preparers credentialed with the IRS, search the Directory of Federal Tax Return Preparers with Credentials and Select Qualifications by clicking here.

Help support the Tampa Free Press by making any small donation by clicking here.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.