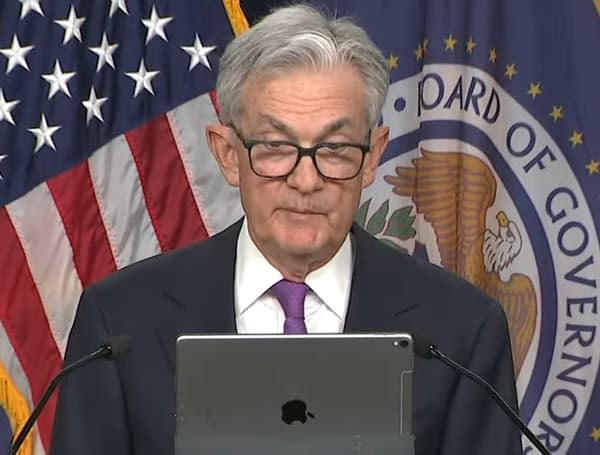

The Federal Reserve took a significant step on Wednesday by cutting interest rates by half a percentage point. This decision marks the beginning of an anticipated period of relaxed monetary policy, with the larger-than-usual reduction driven by increasing worries about the job market.

Policymakers have indicated their expectation for further rate cuts, predicting the benchmark rate to decrease by another half percentage point by year-end. The Fed projects further reductions in 2025 and 2026, with the rate ultimately settling in a range of 2.75% to 3.00%.

Read: Over Quarter Of Democrats Think US Would Be Better Off If Trump Had Been Assassinated: POLL

While acknowledging that inflation “remains somewhat elevated,” this move emphasizes the progress made in controlling inflation and the need to balance various risks. The Fed has stressed its commitment to adjusting monetary policy as required to fulfill its dual mandate of ensuring stable prices and maximizing employment.

This policy shift marks a potential turning point in the economic landscape, with implications for businesses, consumers, and investors alike. The Fed’s future actions will be closely watched as the economy navigates the challenges of inflation and a changing job market.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Android Users: Download our free app to stay up-to-date on the latest news.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.