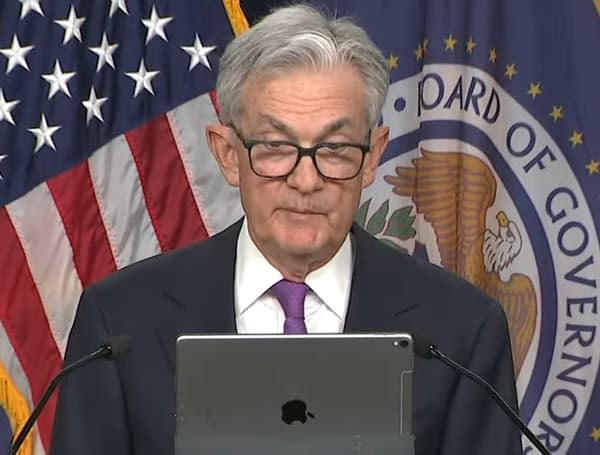

Federal Reserve Chair Jerome Powell indicated on Thursday that the central bank plans to slow down its rate-cutting pace in the coming months. While inflation has shown signs of easing, it remains above the Fed’s 2% target.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell said. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

READ: Military Suicides On The Rise: Pentagon Expresses Concern

Economists anticipate another quarter-point rate cut in December, following a similar reduction in November. However, the outlook for further rate cuts beyond that remains less certain.

While the Fed had previously signaled the potential for four rate cuts in 2025, recent economic data and increased uncertainty have tempered those expectations.

The Fed’s decisions on interest rates have significant implications for the broader economy. Lower interest rates can stimulate borrowing and investment, but they can also contribute to inflationary pressures if not managed carefully.

READ: Texas Man Arrested For Alleged ISIS Terrorist Plot

As the Fed navigates this complex economic landscape, it aims to strike a balance between supporting economic growth and maintaining price stability.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Android Users: Download our free app to stay up-to-date on the latest news.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.