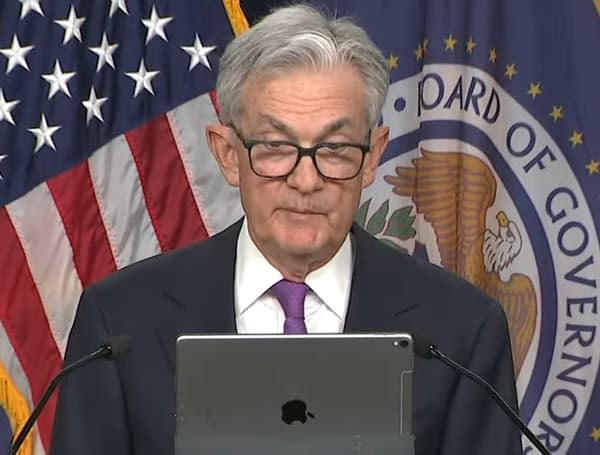

The Federal Reserve announced Wednesday it will maintain its federal funds target range at 4.25% to 4.50%, even as inflation continues to rise. This decision follows the release of the Consumer Price Index (CPI) data for December 2024, which showed a 2.9% increase in the prices of everyday goods. The Fed’s decision aligns with economists’ predictions.

The Fed had previously lowered its target range three times in 2024 in an effort to stimulate the economy. However, inflation remained stubbornly high throughout the year.

READ: Florida Sen. Scott Joins Texas Sen. Cruz Leading Effort On Stop Illegal Reentry Act, Kate’s Law

Polling data from RealClearPolling indicated that a significant percentage of Americans disapproved of the previous administration’s handling of the economy. Many workers also faced challenges due to increased competition in the labor market.

Since assuming office on January 20th, the current president has taken a number of executive actions, including an executive order requiring “emergency price relief.” Additional executive orders have focused on establishing U.S. leadership in digital financial technology and “unleashing American energy” to “restore economic prosperity.”

Economic concerns were a major factor for voters in the recent presidential election. Some recent surveys have indicated improved economic optimism among business leaders and small business owners.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.