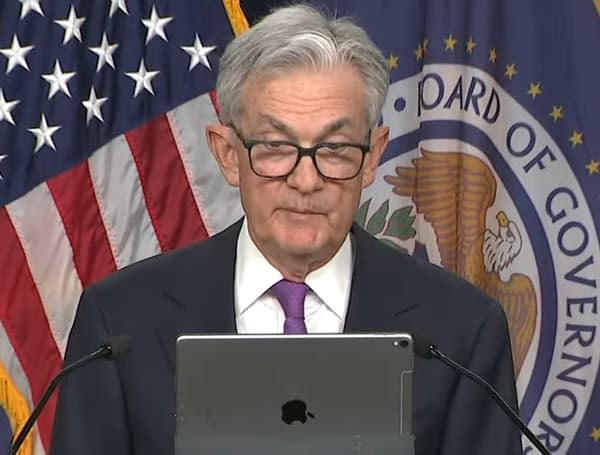

With inflation and the job market showing signs of cooling, Federal Reserve Chair Jerome Powell indicated Friday that the central bank is ready to start cutting its key interest rate, which currently sits at a 23-year high.

Speaking at the Fed’s annual economic conference in Jackson Hole, Wyoming, Powell said, “The time has come for policy to adjust,” though he did not specify when rate cuts would begin or their magnitude.

Economists widely expect the Federal Reserve to announce a modest quarter-point cut in its benchmark rate at its mid-September meeting. Powell emphasized that the timing and pace of rate cuts would depend on incoming data and the evolving economic outlook but hinted that a series of reductions could be on the horizon.

“My confidence has grown,” Powell remarked, pointing to the decline in inflation, which had spiked to the highest level in four decades. Inflation, as measured by the Fed’s preferred gauge, dropped to 2.5% last month—down significantly from its peak of 7.1% two years ago and close to the central bank’s 2% target.

Powell noted that future rate cuts would aim to sustain the economy’s growth and support hiring, which had slowed in recent months. “We will do everything we can to support a strong labor market as we make further progress toward price stability,” Powell said. He also stated that there is a “good reason to think” that the economy will achieve the Fed’s inflation goal while maintaining strong employment.

A potential rate cut in mid-September, occurring just before the upcoming presidential election, could draw political attention. Former President Donald Trump has argued against adjusting rates so close to an election. However, Powell reiterated that the Fed bases its decisions strictly on economic data and not the political calendar.

Read: Crypto Giants Lead Political Spending Surge In 2024 Federal Elections With $119 Million

Powell also took the opportunity to highlight the Fed’s success in curbing high inflation without triggering a recession or causing a sharp rise in unemployment, defying earlier predictions by many economists. He attributed this achievement to the stabilization of supply chains, a cooling labor market, and a reduction in job vacancies, which helped moderate wage growth.

The comments come on the heels of reports that U.S. hiring slowed more than expected in July, with the unemployment rate reaching 4.3%, the highest in three years. This has fueled speculation among some economists that the Fed might implement a larger half-point rate cut in September, with the possibility of another reduction in November.

Read: Mortgage Rates Hit 15-Month Low, Offering Relief To Homebuyers

The Fed’s cautious optimism signals a shift in policy, reflecting its evolving approach to maintaining economic stability.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Android Users: Download our free app to stay up-to-date on the latest news.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.