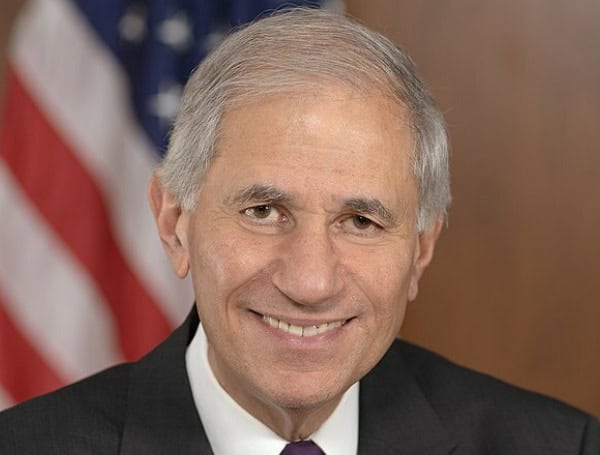

Martin J. Gruenberg, Chairman of the Federal Deposit Insurance Corporation (FDIC), has announced his resignation from the agency.

This decision comes on the heels of a scathing report that unveiled a widespread culture of sexual harassment, discrimination, and interpersonal misconduct within the organization.

As the banking industry’s regulatory watchdog, the FDIC plays a crucial role in maintaining public confidence and stability in the financial system. Gruenberg’s departure, which is set to take effect once a successor is confirmed, has sent shockwaves through the sector, raising concerns about the potential impact on the Biden administration’s financial reform agenda.

“It has been my honor to serve at the FDIC as Chairman, Vice Chairman, and Director since August of 2005. Throughout that time I have faithfully carried out the critically important mission of the FDIC to maintain public confidence and stability in the banking system. In light of recent events, I am prepared to step down from my responsibilities once a successor is confirmed. Until that time, I will continue to fulfill my responsibilities as Chairman of the FDIC, including the transformation of the FDIC’s workplace culture,” said Gruenberg.

The resignation announcement follows the release of a comprehensive 174-page report by the law firm Cleary Gottlieb, which investigated the FDIC’s workplace culture.

The report, based on accounts from over 500 employees, paints a disturbing picture of the agency’s internal dynamics, with allegations of sexual harassment, discrimination, and other forms of inappropriate behavior.

Read: Missouri Rep. Wagner Unloads On FDIC Chairman Over ‘Workplace Misconduct’ Under His Reign

Notably, the report also implicates Gruenberg himself, accusing the chairman of engaging in “bullying and verbal abuse.”

Employees have described Gruenberg as “aggressive” and “harsh,” with accounts of him allegedly screaming profanities at staff members after they delivered unfavorable news.

As the FDIC prepares to welcome a new era of leadership, the task ahead is both daunting and transformative. The incoming chair must not only address the immediate challenges posed by the workplace culture scandal but also chart a bold, forward-looking vision for the agency’s future.

This will require a multifaceted approach that combines trust restoration, comprehensive reform implementation, and strategic reinvention of the FDIC’s role in the rapidly evolving financial landscape.

Help support the Tampa Free Press by making any small donation by clicking here.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.