CLEARWATER, FLORIDA, UNITED STATES, March 22, 2022 /EINPresswire.com/ — The last several years have seen the rise of Special Purpose Acquisition Companies (SPACs) and their role as an increasingly important buyer universe of private companies.

During this same time period, Colonnade Advisors has developed expertise and special relationships with this buyer group. In 2021, Colonnade developed the proprietary SPAC Attack Index to track the amount of capital in the system looking for deals. Please read below for three predictions for the SPAC Attack Index and the impact on the M&A marketplace.

What the SPAC Attack Index Measures

The SPAC Attack Index provides a metric for the amount of capital under “pressure” to be deployed within a specific timeframe. An important consideration of SPAC-related capital is that if a SPAC does not find a merger partner before the end of its two-year lifespan, the SPAC is forced to unwind and return the capital to investors, with the sponsors losing their upfront investment. SPAC capital is under pressure to find a deal in a relatively short timeframe.

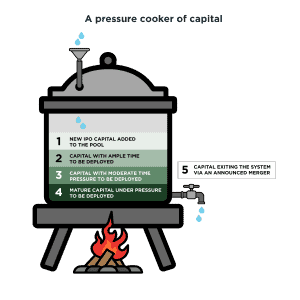

We visualize this pool of capital as if within a “pressure cooker” representing the total amount of capital that has entered from SPAC IPOs, placed under pressure based on the deadline to find a merger partner and de-SPAC.

At the top of the pressure cooker is brand new capital from SPAC IPOs. This new capital adds to the existing layers of capital inside the system, the middle layers of the pressure cooker — capital with ample or moderate time to deploy. At the bottom of the pressure cooker of capital, closest to the fire, is where the most pressure builds. This mature capital under pressure is urgently looking for deals, as the SPACs get close to their maturity dates. Pressure in the system is released when SPACs announce a deal and deploy their capital through a merger or when they unwind and return capital to investors.

With these dynamics in mind, Colonnade’s quarterly SPAC Attack Index incorporates the following metrics, calculated on a per SPAC level. The resulting calculation is an absolute number that we track over time to show relative capital under pressure, which affects the M&A markets.

- The amount of capital looking for deals in any given month;

– The time pressure on that capital, measured across the distribution of SPACs at various points in their lifecycle; and

– The capital exiting the system as SPACs announce merger partners or return capital to investors (de-SPAC).

Three predictions for the SPAC Attack Index and the Impact on the M&A Marketplace

We share three predictions and continue to refine our thinking as we talk with SPAC buyers on a regular basis:

- The SPAC Attack Index is high but is likely to go up even further

When Colonnade Advisors first created the index in Q3/2020, the index measured 237. It rose steadily and broke 1000 in Q3 of 2021. The index increased nearly five-fold in 2021 and was last measured at 1449 in the fourth quarter of 2021. This rise in the index is due to the fact that the “release valve” at the bottom of the capital layers takes time. De-SPACs are complex and time-consuming as investors become more and more selective.

And capital coming in at the top is not slowing down. In Q4/2021, more than 160 new SPAC IPOs injected an additional $33 billion of capital into the system.

- SPACs will expand their mandates

SPACs target a variety of industries, with technology and financial services-focused SPACs consistently being the most popular, owing to their high growth profile. When we ran this data on our initial group of SPACs, the most popular area of focus was Tech, Media, and Telecom. We hypothesized that SPAC mandates would broaden as SPACs come closer to their expiration dates and have found this hypothesis to be true given our recent discussions with SPAC management teams.

We have also found that the initial attractiveness of the “unicorn” companies – early stage, technology-focused sellers – tends to wane as pressure builds to deploy capital and reality sets in. With redemption levels at all-time highs and investors wary of the pre-revenue opportunities, we predict a shift in focus toward established, profitable growth companies with strong management teams.

- Multiples will remain high for M&A transactions

One of the most interesting trends we’ve seen with the SPAC Attack index is the upwards pressure it is putting on deal multiples. We ran a scatter plot analysis with the SPAC Attack index value on one axis and the average M&A multiple on the other. We expected a relationship to exist, but we were genuinely surprised at the high correlation. These analyses can be found at the Colonnade website at www.ColAdv.com/insights.

We expect that multiples will continue to remain high, and 2022 will be a great year for selling companies to take advantage of this eager buyer universe.

It is an exciting time to be in the M&A industry with the rise of SPACs and their important influence on the M&A markets. It is also an exciting time to be a selling company in this dynamic.

<

p class=”contact” dir=”auto” style=”margin: 1em 0″>Jeff Guylay

Colonnade Advisors

jguylay@coladv.com

Visit us on social media:

LinkedIn