Op-Ed By Grover Norquist

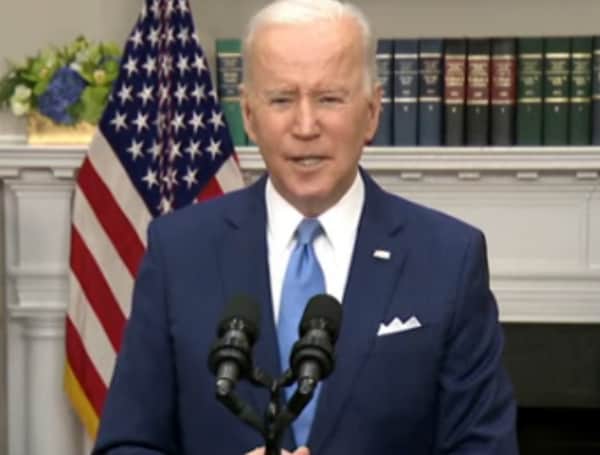

Inflation is running rampant, federal spending is out of control, gas prices are at an all-time high and Americans are pessimistic on the future outlook of the economy. So what is President Joe Biden’s solution?

He has released a budget proposal that includes 36 tax increases on families and businesses totaling $2.5 trillion over the next decade. Alarmingly, this includes 11 tax increases on the oil and gas industry, taxes that will put a burden on households.

The budget doesn’t even include all the tax increases being pushed by Democrats because the budget omits the cost of tax increases within their stalled multi-trillion dollar Build Back Better Act. Instead of detailing these tax increases, the Biden budget includes a placeholder asserting that any new spending will be fully offset.

The tax increases included in this budget are bad enough. The plan calls for raising the corporate income tax hike to 28%. After accounting for state corporate taxes, Biden will give the U.S. a 32% corporate rate, a tax rate significantly higher than Communist China’s 25% tax rate and Europe’s average rate of 19%.

This tax increase won’t fall on large corporations as the administration asserts but will be passed along to families in the form of higher prices of goods and services. For instance, a 2020 study by the National Bureau of Economic Research found that 31% of the corporate tax falls on consumers. This will only exacerbate existing inflation problems and cause the price of everyday products to further increase.

This corporate tax increase will also hit workers in the form of lower wages and fewer jobs. For instance, Stephen Entin of the Tax Foundation has estimated that 70% of corporate taxes are borne by labor. This is alarming because wages are failing to keep up with the pace of inflation. Over the past year, real average hourly earnings have decreased by 2.6%.

Small businesses will also be hit as there are an estimated 1.4 million small businesses organized as C-corporations. Main street businesses have already been hit hard by the pandemic and need tax relief, not tax hikes.

A corporate tax increase will also threaten the life savings of families by reducing the value of publicly traded stocks in brokerage accounts or in 401(k)s. Individual investors opened 10 million new brokerage accounts in 2020 and at least 53% of households own stock. In addition, 80 million to 100 million people have a 401(k), and 46.4 million households have an individual retirement account.

The Biden budget also includes an increase in the top individual income tax rate to 39.6%, a $186.8 billion tax increase. This tax increase will hit small businesses that are organized as sole proprietorships, LLCs, partnerships and S-corporations, accounting for over 90% of all U.S. businesses. These “pass-through” entities pay taxes through the individual side of the tax code.

A significant portion of business income is paid through the individual side of the tax code. As noted in a Senate Finance Committee report, “in 2016, only 42 percent of net business income in the United States was earned by corporations, down from 78.3 percent in 1980.”

In addition, the budget includes 11 different tax increases on the oil and gas industry totaling $45 billion. This includes many provisions that help businesses invest in the economy, creating jobs and lowering energy costs.

Repealing them would only lead to higher prices, less investment and fewer jobs. For instance, the deduction for intangible drilling costs (IDCs) allows independent producers to immediately deduct business expenses related to drilling such as labor, site preparation, repairs and survey work.

As noted in a 2014 study by Wood Mackenzie Consulting, repealing the deduction for IDCs would result in a $407 billion reduction in investment, or roughly 25% of the capital used by producers to continue investing in new projects. This would mean even less oil and higher prices for American consumers.

The cost of energy has increased by 25.6% in the past 12 months and the price of gasoline has increased by 38% in the past 12 month, according to BLS. In light of the Russia-Ukraine war and the Biden administration’s war on American energy, this problem will only get worse.

Biden’s budget to impose $2.5 trillion in tax increases on the American people exposes just how out-of-touch the administration is. Americans are being slugged with surging inflation, low wages, and out-of-control energy costs. Biden’s proposals would only make these problems worse.

Grover Norquist is the president of Americans for Tax Reform.

Visit Tampafp.com for Politics, Tampa Area Local News, Sports, and National Headlines. Support journalism by clicking here to our GiveSendGo or sign up for our free newsletter by clicking here.

Android Users, Click Here To Download The Free Press App And Never Miss A Story. Follow Us On Facebook Here Or Twitter Here.