The Consumer Financial Protection Bureau (CFPB) issued a new rule Tuesday that will hide nearly $50 billion in medical bills from credit reports, a move that could ultimately make life harder for everyday Americans who are already struggling to get by.

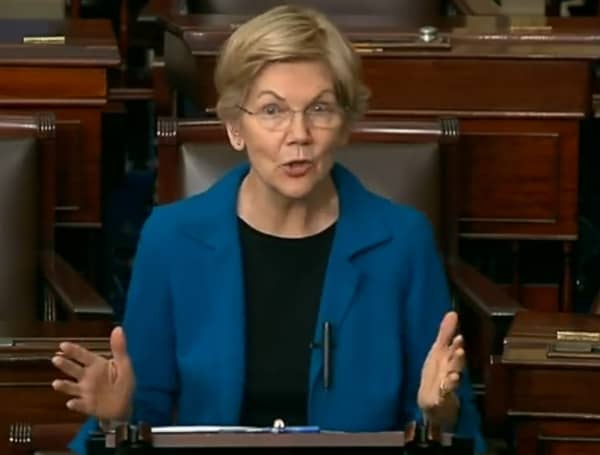

The agency, which Democratic Massachusetts Sen. Elizabeth Warren and current director Rohit Chopra worked together to establish in 2011, finalized the rule less than two weeks before President-elect Trump takes office, claiming that the policy improves privacy protections and prevents debt collectors from coercing people to pay bills they don’t owe.”

While the CFPB claims the policy protects consumers, experts told the Daily Caller News Foundation that wiping medical debt from credit reports will make credit scores less accurate and differentiating between high- and low-risk borrowers more difficult, thereby driving lenders to jack up interest rates and reducing access to credit for low-income Americans.

READ: Trump Team Pushes For Gaza Hostage Release, Ceasefire Deal In Israel

“Removing [medical] information will reduce the predictive accuracy of credit scores for certain borrowers,” Peter Earle, senior economist at the American Institute for Economic Research, told the DCNF. “When lending institutions are unable to differentiate between high- and low-risk borrowers, they are more likely to become risk-averse, either raising the interest rates associated with borrowing or doling out loans with increasing parsimony. With the kind of irony that only government regulators can reliably muster, acting to make credit easier to acquire by blocking lenders’ access to certain data about borrowers will ultimately impact low- and middle-income borrowers negatively, turning affordable or significant borrowing into a privilege reserved for the wealthy.”

“The rule will increase the reliability of credit reports because medical bills are a poor predictor of someone’s ability to repay a loan,” a CFPB spokesperson claimed in a statement to the DCNF. However, CFPB director Chopra appeared to say the exact opposite in a May 2023 speech, when he cited a 2019 National Institutes of Health study that found 66.5% of personal bankruptcies were linked to medical debts.

READ: CBP Officers In Texas Seize $21.2 Million In Meth Hidden In Tomatillo Shipment

A CFPB spokesperson also told the DCNF “The credit reporting industry has recognized how medical bills can decrease trust in credit scores,” and has “already decreased [its] reliance on medical bills in credit reports.” However, Equifax — the second-largest credit bureau in the U.S. — explicitly requested the agency withdraw the rule prior to its finalization, arguing in a comment letter that the CFPB did not provide sufficient evidence to prove medical debts are inaccurately reported or that medical debt information is not an effective indicator of creditworthiness, therefore making the rule “arbitrary and capricious.”

Equifax’s argument that the rule is “arbitrary and capricious” appears to hold water, Erik Jaffe, partner at law firm Schaerr Jaffe LLP, told the DCNF : “The argument that the CFPB does not have the authority to implement an outright ban on the inclusion of medical debt seems persuasive,” Jaffe said. “This would probably be a good example of an agency overreaching given the extensive consequences of the policy and the seemingly lousy job the agency did in evaluating those consequences.”

Republican lawmakers have decried the rule following its finalization.

“With just days left in the Biden administration, CFPB Director Chopra is pressing forward in his pursuit of headlines and political talking points over sound policy decisions,” incoming Senate Banking Committee Chairman Tim Scott of South Carolina wrote Tuesday. “Medical debt is a serious challenge for many Americans, but the CFPB’s final rule will do nothing to address the underlying issues. Instead, the rule will reduce access to credit and important health care services while putting lenders and medical providers at risk.”

READ: Massachusetts Man Charged With Trafficking Cocaine From California Through The Mail

Scott’s counterpart in the House, incoming Financial Services Committee Chairman French Hill of Arkansas, also blasted the CFPB’s “midnight rulemaking” Tuesday: “Director Chopra’s eleventh-hour effort to appease the White House is just another example in a long line of poor decision-making under his leadership. Instead of focusing on enhancing economic opportunity for all consumers, Chopra’s regulatory overreach will drive up costs to any American seeking medical care and have a devastating impact on consumers’ access to healthcare, particularly in rural areas.”

Under President Joe Biden, the CFPB has sought to increase red tape for the financial services industry, cutting late fees for credit card payments and capping overdraft penalties — a move that experts previously told the DCNF would limit access to credit and financial services for low-income Americans, and push more borrowers to turn to often predatory payday lenders.

The rules are part of a broader regulatory push from the Biden administration that brought the total costs of federal regulations to a record $2.1 trillion in 2023, according to the Competitive Enterprise Institute.

Many Americans are already struggling to meet debt obligations without the potentially costly CFPB regulation, with household debt standing at a record high of nearly $18 trillion at the end of the third quarter of 2024, up almost $4 trillion from when President Joe Biden took office in the first quarter of 2021, according to the Federal Reserve Bank of New York. Credit card balances have also surged since the COVID-19 pandemic, with American households holding $1.17 trillion in credit card debt in the third quarter of 2024, up from $770 billion in the first quarter of 2021.

E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF the rule was a “classic example” of CFPB policy purporting to protect the American consumer while doing the exact opposite.

“This is a classic example of the CFPB failing to live up to its name,” Antoni said. “Everything it does harms consumers financially, instead of protecting them.”

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.

First published by the Daily Caller News Foundation.