Dollar stores are reporting softened demand and increased financial stress among their lower-income consumers, according to The Wall Street Journal.

Some businesses say their customers are spending less money toward the end of the month and more focused on purchasing from cheap store brands, according to the WSJ. Dollar General said in a December earnings call that its best-performing category in its last quarter was its “value valley” aisle, which offers $1 products, the WSJ reported.

READ: Michigan Dems Rush Gun Control Through State Legislature Ahead Of Republican House Majority

Dollar stores are also saying that consumers put off shopping for special occasions like Halloween until the last minute, according to the WSJ. Walmart CEO Doug McMillon said at a conference on Dec. 3 that the “inflationary cycle has been really detrimental” for lower-income families, the WSJ reported.

The Atlanta Fed’s Wage Growth Tracker, a measure of the nominal wage growth of individuals, was down to 4.3% in November compared to 6.7% in June 2022, according to the Federal Reserve Bank of Atlanta. Inflation takes a bigger financial toll on low-income individuals, according to Investopedia. Although low-income workers saw substantial wage gain growth following the pandemic, the growth rate has slowed, according to Investopedia.

READ: ‘The View’ Co-Host Ponders Whether Trump Is Really So Extreme After All

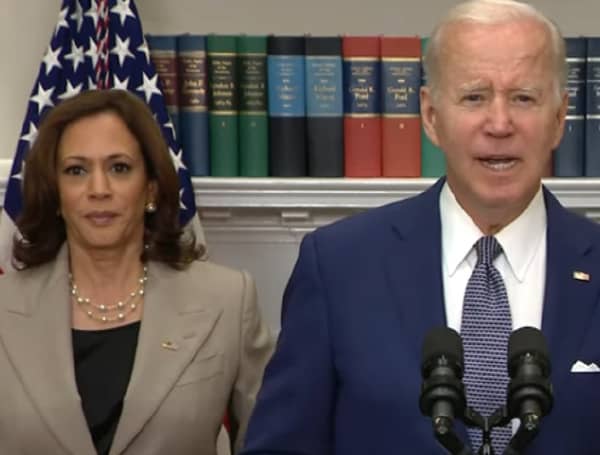

Many consumers have been under financial pressure during the Biden-Harris administration due to high inflation and increased costs. The rise in the consumer price index, a measure of the cost of living, in November was in line with economists’ expectations, with a month-over-month inflation rise of 0.3% and a year-over-year increase of 2.7%, according to the Bureau of Labor Statistics. Inflation hit a peak of 9.1% in June 2022.

Several retailers have announced store closures this year amid various business struggles such as high costs. Dollar Tree and its subsidiary Family Dollar announced in March plans to close around 1,000 stores over the next several years after failing to turn sales around, and 7-Eleven announced in October plans to shut down nearly 450 stores across the U.S.

Problems such as messy stores and limited e-commerce businesses have also negatively impacted some dollar stores, according to CNBC.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.

First published by the Daily Caller News Foundation.