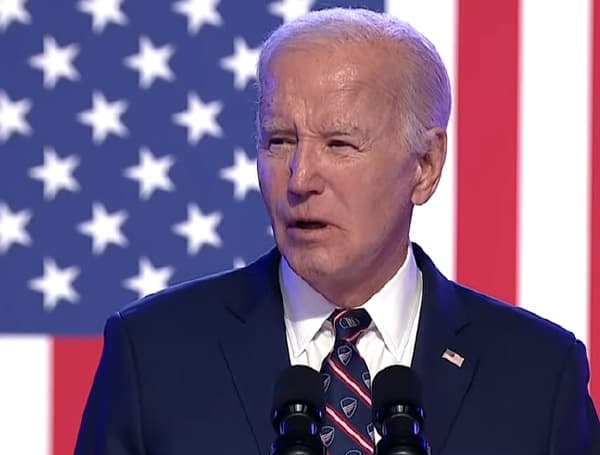

In a move that has sparked widespread debate, the Biden administration has proposed a plan to extend healthcare subsidies to Deferred Action for Childhood Arrivals (DACA) recipients, a group of undocumented immigrants who arrived in the United States as children.

While the administration touts this as a compassionate effort to provide access to affordable medical care, the Congressional Budget Office (CBO) has sounded the alarm, warning that this policy change could add billions of dollars to the federal deficit over the next decade.

The Affordable Care Act (ACA) introduced the Premium Tax Credit, a refundable tax credit that helps eligible individuals and families purchase health insurance through the marketplaces. The credit is calculated based on the difference between the benchmark premium and a specified maximum contribution, which is a percentage of the household’s income.

Read: Biden’s Top Brass Says Israel May Have To Go It Alone If All-Out War With Hezbollah Kicks Off

In 2021, the American Rescue Plan Act (ARPA) expanded the eligibility for the Premium Tax Credit, allowing individuals with incomes above 400% of the federal poverty level (FPL) to qualify. The 2022 reconciliation act further extended these expanded subsidies through 2025.

The Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) have analyzed the potential impact of making the expanded Premium Tax Credit structure permanent. Their findings suggest that this move would have significant budgetary consequences.

Increased Federal Deficits

CBO and JCT estimate that a permanent extension of the expanded Premium Tax Credit would increase the federal deficit by $335 billion over the 2025-2034 period. This figure includes a $415 billion increase in the cost of the Premium Tax Credit, offset by a $60 billion decrease in revenues and a $20 billion increase in spending for other programs.

Read: Florida Rep. Díaz-Balart Rips Biden’s Immigration Executive Order As ‘Political Move’

Shifts in Health Insurance Coverage

The CBO and JCT analysis indicates that a permanent extension would lead to several changes in health insurance coverage:

- A 6.9 million net increase in marketplace enrollment, with a 7.4 million increase in subsidized enrollment and a 600,000 decrease in unsubsidized enrollment

- A 500,000 combined increase in Medicaid and CHIP enrollment

- A 500,000 decrease in non-group coverage purchased outside the marketplaces

- A 3.5 million decrease in employment-based coverage

The CBO and JCT report also examines the specific impact of the policy change on DACA recipients. Under current law, the Centers for Medicare & Medicaid Services (CMS) issued a final rule in 2024 that made DACA recipients eligible for the Premium Tax Credit.

Increased Enrollment and Costs

CBO and JCT estimate that under current law, about 110,000 DACA recipients will enroll in marketplace coverage each year, increasing the deficit by $7 billion over the 2025-2034 period.

If the expanded Premium Tax Credit structure is made permanent, the number of DACA recipients enrolling in marketplaces is expected to increase to 140,000 per year, adding another $2 billion to the deficit.

Debt-Service Costs

In addition to the direct budgetary impact, the CBO and JCT analysis indicates that the increased deficit associated with the DACA-related policy changes would result in $2 billion in additional debt-service costs over the 2025-2034 period.

Potential Implications for Employers and Employees

The CBO and JCT analysis suggests that the permanent extension of the expanded Premium Tax Credit could have significant implications for employer-sponsored health insurance.

Decline in Employer-Sponsored Coverage

The agencies estimate that a permanent extension would lead to a 3.5 million decrease in enrollment in employment-based coverage. This is because employers may be more likely to discontinue offering health insurance if the expanded subsidies become a permanent feature of the healthcare landscape.

Impact on Employees’ Tax Benefits

CBO and JCT estimate that the individuals who no longer enroll in employment-based coverage due to the permanent extension would have received an average annual tax benefit of $4,350. This tax benefit reflects the exclusion of premiums from income and payroll taxes.

Increased Enrollment and Costs in the Marketplaces

The CBO and JCT analysis indicates that the permanent extension of the expanded Premium Tax Credit would lead to a significant increase in enrollment in the health insurance marketplaces.

The agencies estimate that the policy change would attract an additional 6.9 million enrollees to the marketplaces, on average, each year over the 2025-2034 period.

This would result in a $369 billion increase in the cost of the Premium Tax Credit, accounting for 89% of the total $415 billion increase in the credit’s cost.

Income Distribution of New Enrollees

CBO and JCT estimate that about half of the increase in enrollment and 69% of the total cost of the Premium Tax Credit for people who enrolled because of the permanent extension would be for individuals with incomes below 400% of the FPL. The average credit for these enrollees is larger than the credit for those above the 400% FPL threshold.

Fully Subsidized Marketplace Plans

The CBO and JCT analysis also sheds light on the potential impact of the permanent extension on the number of individuals enrolled in fully subsidized marketplace plans.

Estimated Enrollment in Fully Subsidized Plans

The agencies estimate that under a permanent extension, approximately 30% of marketplace enrollees, or about 7 million people, would enroll in plans with fully subsidized premiums. This includes individuals whose incomes are below 150% of the FPL and those whose required contributions would be fully covered by the Premium Tax Credit.

Potential Implications

The high proportion of fully subsidized enrollees could have implications for the overall cost and sustainability of the marketplace system, as well as the potential for individuals to select lower-cost plans that may require higher out-of-pocket spending.

Help support the Tampa Free Press by making any small donation by clicking here.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.