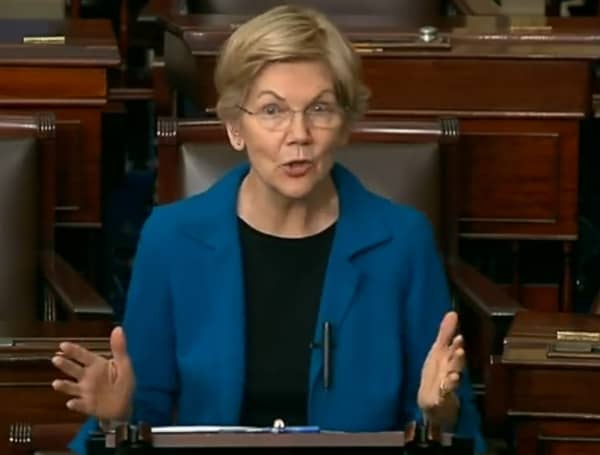

As the Federal Reserve (the Fed) continues to keep interest rates at their highest levels in over two decades, a trio of Democratic senators – Elizabeth Warren (D-Mass), Jacky Rosen (D-Nev), and John Hickenlooper (D-Colo) – have stepped forward to voice their concerns.

In a strongly worded letter to Fed Chair Jerome Powell, the senators have urged the central bank to reverse course and cut rates, arguing that the current monetary policy is exacerbating the affordability crisis in the housing and insurance sectors.

The senators’ plea comes at a critical juncture, as major central banks around the world, including the European Central Bank, have already begun lowering interest rates in response to shifting economic conditions.

Read: Illinois Rep. LaHood Uncovers How A Chinese Battery Giant Is Fueling The Uyghur Genocide

“The Fed’s decision to keep interest rates high continues to widen the rate gap between Europe and the U.S, as the lower interest rates could push the dollar higher, tightening financial conditions,” wrote the senators. “The Fed’s current interest rate policy is also having the opposite of its intended effect: it is driving up housing and auto insurance costs, which are currently the main drivers of the overall inflation rate.”

However, the Fed has remained steadfast in its decision to maintain high rates, despite growing calls from economists, policymakers, and now, these influential senators, to provide much-needed relief to American consumers.

Since March 2022, the Fed has raised interest rates eleven times, pushing them to their highest levels in over 20 years. Despite calls for rate cuts from many economists and legislators, the Fed has yet to lower rates at home, threatening the economy and causing housing and auto insurance costs to rise.

These two factors, combined with price gouging and corporate greed by big businesses, serve as the main drivers of persistently high costs that continue to harm working families across the country.

On housing prices, the senators wrote: “The country is already facing a severe housing shortage, and the Fed’s refusal to bring down interest rates is exacerbating this shortage and driving higher inflation rates…Lower mortgage rates would encourage more people to sell their homes, which would in turn increase housing supply, decrease prices, ease the costs of renting, and ultimately increase homeownership.”

On auto insurance rates, the senators continued: “(T)he increase in the cost of motor vehicle insurance reflects factors including a shortage of mechanics, more severe and frequent car accidents, climate change leading to more vehicles damaged by extreme weather, and more complex cars that are more expensive to repair. None of these factors are mitigated by high interest rates.”

“The Fed’s monetary policy is not helping to reduce inflation. Indeed, it is driving up housing and auto insurance costs—two of the key drivers of inflation—threatening the health of the economy and risking a recession that could push thousands of American workers out of their jobs. You have kept interest rates too high for too long: it is time to cut rates,” concluded the senators.

Help support the Tampa Free Press by making any small donation by clicking here.

Android Users, Click To Download The Tampa Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.