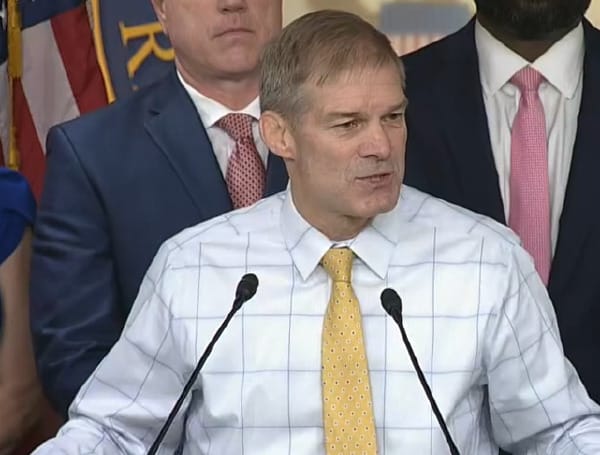

House Judiciary Committee Chairman Jim Jordan sent a letter to the Internal Revenue Service (IRS) Friday demanding to know why an agent had told a woman that he could “go into anyone’s house at any time I want.”

Jordan revealed in the letter that he’d recently learned of allegations about an IRS agent who had allegedly used a fake name to enter a taxpayer’s home and then threatened her. The letter explained that an agent going by “Bill Haus” showed up at an Ohio woman’s home in April, telling her that he can “go into anyone’s house at any time.”

“We have recently received allegations that an Internal Revenue Service agent provided a false name to an Ohio taxpayer as part of a deception to gain entry into the taxpayer’s home to confront her about delinquent tax filings,” the letter reads. “When the taxpayer rightfully objected to the agent’s tactics, the IRS agent insisted that he ‘can . . . go into anyone’s house at any time’ as an IRS agent. These allegations raise serious concerns about the IRS’s commitment to fundamental civil liberties.”

In the news: Bill Clinton Won ‘Sock Drawer’ Tapes Lawsuit, Here’s What That Could Mean For Trump

Haus allegedly entered the woman’s home, claiming she owed a significant amount in taxes for an estate of which she was a “fiduciary,” according to the letter.

Later, the agent allegedly told the woman that he was actually there to discuss “several delinquent tax return filings” from the estate’s deceased owner.

After calling her attorney, the woman was instructed to tell the agent to leave but he refused, claiming that he could be at any house at “any time,” according to the letter. Haus eventually left but allegedly “threatened that she had one week to satisfy the remaining balance or he would freeze all her assets and put a lien on her house.”

The woman called the police, who then contacted Haus and determined that he was using a false identity, instructing him to stay away from the taxpayer, according to the letter. In response, Haus allegedly filed a complaint against the officer with the Treasury Inspector General for Tax Administration.

The taxpayer later spoke with Haus’ supervisor on May 4 who informed her that nothing was owed on the estate and that “things never should have gotten this far,” according to the letter. The case was then closed the following day.

In the news: Federal Court Strikes Down Costly Biden Admin Regs Hampering Lobster Fishermen

As a result, Jordan ordered the IRS to send all documents and communications on this incident to the committee, including all communication between the agency and the Treasury Department or “any other Executive Branch entity” with a deadline of June 30 at 5 p.m., according to the letter.

“This behavior from an IRS agent to an American taxpayer—providing an alias, using deception to secure entry into the taxpayer’s home, and then filing an Inspector General complaint against a police officer examining that matter—is highly concerning,” Jordan wrote in the letter.

The IRS has come under scrutiny recently after an agent showed up unannounced at the home of independent journalist Matt Taibbi in May while he was testifying to the Select Subcommittee on the Weaponization of the Federal Government.

Android Users, Click To Download The Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Signup for our free newsletter.

We can’t do this without your help; visit our GiveSendGo page and donate any dollar amount; every penny helps.